Import volume at major retail container ports seen rising

For retailers hungering for a hint of good news amidst a wave of store closings and bankruptcy filings, here’s a positive sign: import volume at major retail container ports suggests a bright outlook for this year’s holiday season.

August container shipments to the US could rise 2.2%, according to the monthly Global Port Tracker report released by the National Retail Federation and maritime consulting firm Hackett Associates. That would bring the measure to the highest level since the NRF began tracking imports in 2000. The report also projects rising volume for June, July, September and October before an estimated decline in November. The actual volume in May, the most recent month when actual figures are available, saw import volume rise 6.2% from a year earlier.

While the cargo volume doesn’t correlate directly with sales because it doesn’t factor in the value of goods inside the containers, it’s a signal of retailers’ expectations, the NRF said.

“Retailers are expecting a positive holiday season,” Jonathan Gold, the NRF’s vice president for supply chain and customs policy, said in an interview. July through September represents the peak period for retailers to bring in their holiday shipments, he said.

While the NRF doesn’t yet have this year’s holiday sales forecast, the retail trade group has forecast 2017 retail sales, excluding automobiles, gas stations and restaurants, will rise as much as 4.2% to a record from $3.4 trillion last year. It projects online and other non-store sales will drive the growth, up between 8% and 12% this year.

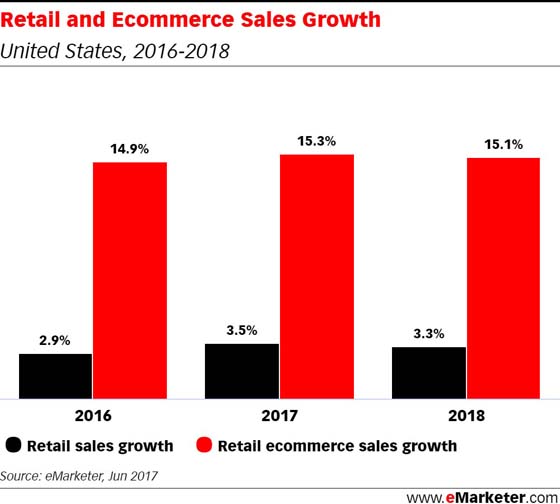

By comparison, eMarketer estimates that overall retail sales (also excluding restaurants, but including auto and gas sales) will rise 3.5% this year, while ecommerce sales will rise 15.3%.

The NRF’s Gold noted that the retail industry, despite negative headwinds, has made gains. “A lot of the news is focused on retailers closing stores,” he said. But retailers like dollar stores “have been expanding. Ecommerce also continues to grow. The industry is changing and adapting to consumer demand.”

Even though the 2016 holiday season was disappointing for retailers from Macy’s to Target, the trade group’s numbers said the industry as a whole registered a record $655.8 billion in 2016 sales, up 3.6%. Indeed, online retail giant Amazon reported its best holiday season sales and many brick-and-mortar retailers also saw gains online while comparable same-store sales at their physical store outlets dropped.

With advanced marketing technologies comes a slew of data advertisers can use to grab the attention of their consumers at key moments in their path to purchase. This Roundup looks at how personalized messaging delivered at the right time is crucial in today’s fragmented customer journey.

Online isn’t the only bright spot of the industry. Even though retailers from RadioShack and Payless ShoeSource to Sears and JC Penney have announced a total of more than 5,300 store closings so far this year, others are expanding, according to a recent Fung Global Retail & Technology study. The report showed during the same time those store closings were announced, retailers including Dollar General, TJ Maxx parent TJX, Ulta Beauty and German grocer Lidl have announced nearly 3,300 store openings, up 53% from a year earlier.

There’s also another likely driver behind the potentially record import volume to the top US retail ports led by Los Angeles/Long Beach ports. Freight rates from Asia to US, which represents the bulk of US retail imports, are at historically low levels, Dan Hackett, a partner at Hackett, told eMarketer Retail.

“Profit margins are tight,” Hackett said. With retailers including Target, Walmart and Home Depot competing against online retailers, shipping goods in while freight rates are low gives them an opportunity to save costs.

by Andria Cheng