Still, that wasn’t enough to impress investors—at least, not yet.

The overlooked beauty of brick-and-mortar retail is how well retail chains lend themselves to what economists call price segmentation. Shoemakers such as Nike can easily target customers by sending the right shoes to the right kind of store (think: first-class vs. coach, iPhone X vs. iPhone 8, Banana Republic vs. Old Navy). In Nike’s case, it ships expensive, limited edition sneakers to high-end boutiques, routes its stock Jordans to chains like Foot Locker Retail Inc., and dumps its low-end product and off-key colorways in such places as DSW Inc.

If done correctly, all this socioeconomic slotting moves as much merchandise as possible with minimal fuss, while not tarnishing the larger brand. And make no mistake: Nike does it correctly. On its face, the Swoosh is a design shop supercharged by the kind of storytelling its TV commercials, billboards and magazine ads are famous for. But Nike’s real genius isn’t marketing, it’s merchandising: knowing exactly what to ship where. For every sneaker sketching savant in Beaverton, Oregon, there’s a mid-level manager with a giant spreadsheet, making sure “Momofuku” Dunks aren’t too easy to find, ordering up a special design for China, distributing its best-sellers to all the right Dick’s Sporting Goods Inc. outlets and dumping plenty of Chuck Taylors at outlet malls.

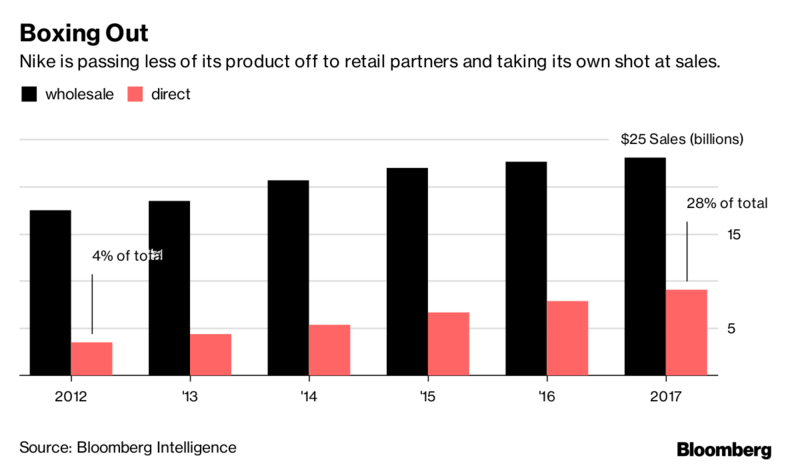

Nike is now upsetting its own well-oiled applecart. In giving traditional retail the stiff arm, which Nike made official in June, the Oregon empire is tearing up that playbook and trying to make an end run around the basic economics of price segmentation. The strategy—a bold move, given the historical manufacturer-to-retail model being discarded—requires no shortage of swagger. But Nike’s numbers show that the bet appears to be working, primarily because Nike has been sharpening its digital game.

Sought-after sneakers now ship out via Nike’s own ecosystem of apps, including SNKRS, which it launched early last year. The heart of its lineup, meanwhile, sells on Nike.com and in its own big box stores. As for the cheaper, less-popular kicks, they quietly trickle into the company’s “factory” stores (read: outlet) and onto Amazon.com. Nike even has a studio in New York that makes customized shoes on-site in about an hour.

In short, the company is deemphasizing its ready made network of retailers to create an even more precise targeting mechanism.

Yesterday, Parker said the end goal is to get ahead of the consumer and offer “the most personal, digitally connected experiences” in the industry. “While changing your approach is never easy, Nike has proven before that when we do, it’s always ignited the next phase of growth for our company,” he explained.

In theory, Nike can know any given customer better—and his or her willingness to pay—by using its own venues and platforms, particularly on its digital properties. The challenge will be building the mechanism to sort all the data, and in doing so, the customers. In the real world, they sort themselves: The high-end boutique isn’t right next to the cut-rate discount outlet. In the virtual world, it’s not so easy.

For the record, Under Armour Inc. is slightly ahead of Nike Inc., with 31 percent of its sales coming directly from consumers; Adidas AG is slightly behind, with 23 percent of revenue from retail. At its current pace, Nike will soon be collecting one in three of its sales dollars directly from consumers. Its challenge will be making sure that none of them get too good a deal.

By Kyle Stock Source: Bloomberg, September 2017