This story was delivered to BI Intelligence “E-Commerce Briefing” subscribers. To learn more and subscribe, please click here.

Several major department store chains reported Q3 earnings last week, and the results, for the most part, point to a continuing trend of struggling sales among traditional retailers.

- Macy’s posted a significant decline in same-store sales. The department-store chain reported a 4% year-over-year (YoY) drop in the metric. That’s particularly disappointing, because declines cooled to 2.8% YoY in Q2, but are now closer to the 5.2% drop they saw in Q1. Macy’s total sales fell 6.1% YoY to $5.3 billion, though digital sales saw “double-digit growth,” which Macy’s didn’t elaborate on.

- JCPenney and Nordstrom posted mixed results, as each adjusted the number of its stores. JCPenney’s total sales dropped to $2.81 billion, down 1.8% YoY, but its same-store sales increased 1.7%. This is likely due to the retailer closing a large number of its stores, but it may have successfully identified strong locations to move forward with. Nordstrom’s total sales climbed 2% YoY to reach $3.5 billion, while its same-store sales dropped .9%. The boost in total sales was likely affected by the retailer’s new store openings — Nordstrom will likely want to work to raise its same-store sales growth back to the 1.7% it posted in Q2. The retailer did see strong growth on Nordstrom.com and Nordstrom Rack’s website, with increases of 7.5% YoY and 33.6% YoY, respectively.

- Kohl’s managed slightly above flat growth while its peers struggled. The retailer reported same-store sales growth of .1% YoY, and its total sales were up $5 million YoY to $4.3 billion. While flat growth is not necessarily desirable, it’s more favorable in an environment where other players are seeing consistent declines.

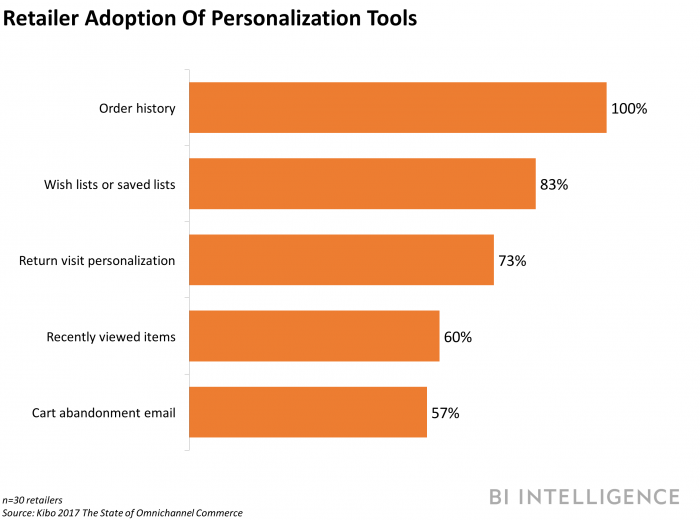

The retailers are looking to personalization and omnichannel to help boost their future performance. Both areas have shown to be valuable, and these four retailers are making concerted efforts to take advantage of them to boost sales.

- Macy’s has revamped its loyalty program in the hopes of better connecting with its top customers.

- Nordstrom has launched new store formats and services to give customers more shopping options, and is piloting 24-hour curbside pickup for the holidays.

JCPenney and Kohl’s both fulfilled 30% of their online orders in-store in Q3, effectively leveraging their physical locations. JCPenney has also increased site conversion and app downloads by investing more heavily in e-commerce, and Kohl’s has bolstered its analytics to improve its personalization and search capabilities.

Jonathan Camhi, research analyst for BI Intelligence, Business Insider’s premium research service, has laid out the case for why retailers must transition to an omnichannel fulfillment model, and the challenges complicating that transition for most companies. This omnichannel fulfillment report also detail the benefits and difficulties involved with specific omnichannel fulfillment services like click-and-collect, ship-to-store, and ship-from-store, providing examples of retailers that have experienced success and struggles with these methods. Lastly, it walks through the steps retailers need to take to optimize omnichannel fulfillment for lower costs and faster delivery times.

Here are some of the key takeaways from the report:

- Brick-and-mortar retailers must cut delivery times and costs to meet online shoppers’ expectations of free and fast shipping.

- Omnichannel fulfillment services can help retailers achieve that goal while also keeping their stores relevant.

- However, few retailers have mastered these services, which has led to increasing shipping costs eating into their profit margins.

- In order to optimize costs and realize the full benefits of these omnichannel services, retailers must undertake costly and time-consuming transformations of their logistics, inventory, and store systems and operations.

In full, the report:

- Details the benefits of omnichannel services like click-and-collect and ship-from-store, including lowering delivery times and costs, and driving in-store traffic and sales.

- Provides examples of the successes and struggles various retailers have experienced with omnichannel delivery.

- Explains why retailers are having trouble managing costs with their omnichannel fulfillment efforts, which are eating into their profits.

- Lays out what steps retailers need to take to optimize costs for their omnichannel operations by placing inventory where it best meets customer demand.

by Daniel Keyes