Target, Costco among early holiday season winners

Consumers continue to shift more of their holiday spending online, but that doesn’t mean that online retailers (led by Amazon, of course) are the only success stories this holiday season. A number of brick-and-mortar retailers, having invested in upping their online game, are now seeing those efforts pay off.

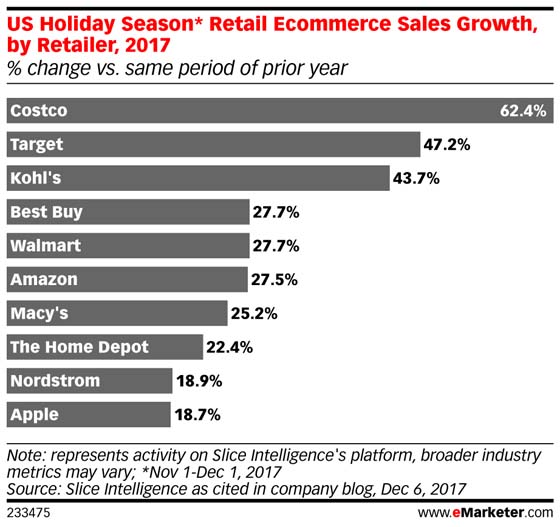

Among physical retailers, Target and Costco look to be early season winners. Between Nov. 1 and Dec. 1, Target has seen its online sales surge 47%, increasing its share of the market by 0.47 percentage points to 3.17% from a year earlier, according to Slice Intelligence, which tracks online receipts from a panel of 5 million shoppers. That’s the biggest pickup among 10 major online retailers Slice tracks. Industry leader Amazon, which saw its sales rise a little more than 27%, was the only one seeing a bigger share pickup, up 0.5 percentage points to 33.66% season to date, a Slice market share study for eMarketer Retail showed.

Amid growing concerns about whether it’s “un-Amazonable,” especially in the wake of Amazon’s Whole Foods buy, Costco’s online performance should ease the minds of skeptics. Among the 10 major online retailers Slice tracked in a study released Wednesday, Costco actually saw the biggest percentage gain of 62%. Its share of the online market rose by 0.34 percentage points to 1.48%.

Kohl’s saw sales jumping 44% to increase its year-over-year share to 2.24% season to date. Best Buy and Walmart each saw their sales rising 28%, upping their respectively share of the market by less than 0.1 percentage points to 4.49% and 2.67%.

To be sure, brick-and-mortar retailers still have a long way to go to catch up to Amazon.

The combined market share of the nine major online retailers ex Amazon together rose by almost one percentage point to a total of 21.38% season to date, still more than 12 points below that of Amazon.

Still, while those share gains may not sound like that much, they do add up when looking at the entire online pie. Adobe, which tracks 80% of online transactions at the largest 100 US online retailers, said in a separate study released Wednesday that online sales from Nov. 1 through Monday rose nearly 15% to $65.15 billion.

Also noteworthy, this is the first time Adobe has seen each day of the season to date surpass $1 billion in online sales. Adobe also kept its prior forecast that online sales this holiday would reach a record $107.4 billion, crossing the $100 billion mark for the first time.

Other studies also suggest that Target is an early season winner. While major online retailers including Amazon, Best Buy and Walmart all saw “busy” online sales, Target, for instance, saw online sales on Thanksgiving day surging close to 15x its previous four Thursdays while its Cyber Monday sales were nearly 10x the sales of the previous four Mondays, according to Edison Trends, which said it tracks online receipts from a panel of more than 2.7 million consumers. Among major retailers promoting deals during Thanksgiving week, Target saw the biggest gain, with online sales rising by about 4.5 times its prior four-week average, according to Edison Trends.

Like other brick and mortar retailers, Target has unveiled various initiatives to compete with Amazon. The company said last month that its physical stores will play bigger roles as online fulfillment centers this holiday season as its physical stores will handle more than 80% of online order volume during peak holiday shopping period this year, up from more than half regularly.

In another illustration of the blurred line between online and brick-and-mortar, Target this week introduced a mobile payment feature within its online app that in-store shoppers can use for faster check-out while combining Target’s online Cartwheel savings offers and weekly ad coupons.

Costco, for its part, has in recent months introduced initiatives including free two-day nationwide delivery of nonperishable items for orders over $75, which the company has said allows it to reach locations where it doesn’t have a physical presence. Costco CFO Richard Galanti admitted in October the company gets questions “literally everyday” regarding the impact of Amazon thanks to increased Amazon Prime and Costco membership overlap. He said then Costco hasn’t seen any impact.

by Andria Cheng