Furniture and home goods lead digital and in-store sales growth

Despite persistent gloom and doom surrounding the retail industry, the first half of the year has been positive for most product categories. According to the newly released monthly retail sales report from the US Census Bureau, for H1 2018, retail sales (excluding auto parts and gasoline) totaled $2.06 billion, up 4.9% year over year.

With the exception of sporting goods, which shrunk 1.7%, and department stores that stayed flat, all other segments experienced growth in H1 2018. Furniture and home goods (5.3%) and apparel (5.1%) saw the biggest gains.

Now par for the course, ecommerce outperformed total retail with 10.0% gains during H1 2018 compared with the same time last year.

According to a June 2018 eMarketer forecast, US retail ecommerce will grow 16.0% to $525.7 billion this year. The leading categories by sales are consumer electronics ($115.1 billion) and apparel and accessories ($103.6 billion), showing how comfortable consumers are with buying items like mobile phones and clothing online.

Meanwhile, The NPD Group just released its analysis of those same two categories. Online sales of consumer technology were up 16% for the 12 months ending May 2018, though the average spend per purchase was down 7% as shoppers are buying more low-cost items. Among US digital buyers, 43% made a consumer electronics purchase in the past year, up from 37% in 2017. Categories with the highest penetration were cell phone accessories (22%), portable audio (18%) and mobile power (13%), all lower-consideration items. Many still shop in-store for major purchases like TVs or laptops.

What’s more, 21% of apparel sales in 2017 occurred online, while 76% transacted in-store, NPD reports. But channels are shifting. Online sales grew 7%, while in-store sales declined 3%.

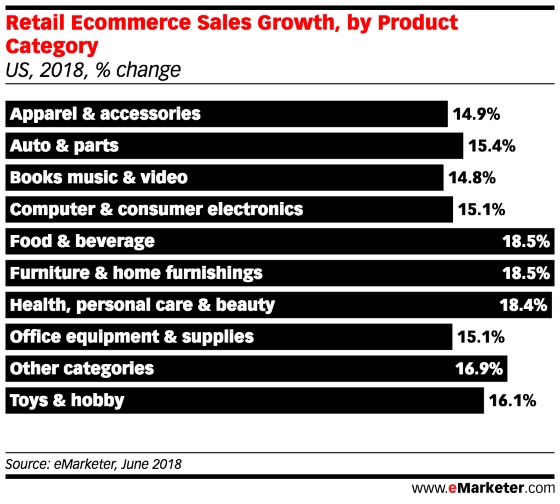

The product categories that have grown the most in 2018, according to eMarketer, are food and beverage (18.5%), furniture and home furnishings (18.5%) and health, personal care and beauty (18.4%).

Food and beverage has traditionally been one of the ecommerce categories with low penetration, so grocers and big-box retailers have been upping tech investments to offer more and faster fulfillment options, curbside pick-up and same-day delivery.

Consumers have been more receptive to buying furniture digitally. Home goods (and home improvement) stores have been at the cutting edge of using augmented reality (AR) and virtual reality (VR) for visualizations to allow shoppers to imagine how a new sofa or counter-top will look in a living room or kitchen.

And the digital beauty space, which has been dominated by Ulta and Sephora, is being encroached upon by Amazon. According to a Deutsche Bank analyst, Amazon carries 94% of Ulta’s best-selling products, and in June launched an indie beauty shop, selling many brands that the two big competitors don’t.

by Krista Garcia