An ongoing shift in pet purchasing channels as well as slowed new pet ownership growth are rearranging the landscape of market dollars. | Anchiy, iStockPhoto.com

Source: www.petfoodindustry.com, October 2018

Channel migration and a stagnation of new pet ownership numbers are changing the landscape of pet food dollars.

The U.S. pet industry, which Packaged Facts estimates at US$85.6 billion in 2017, continues along a healthy growth trajectory. Two overlapping trends, both in force for nearly two decades and both primarily marketing-driven, continue to influence the infusion of new products and services into the U.S. pet market: humanization and premiumization.

Strong numbers for pet food contributed to the advancement of the industry: retail channel pet food sales rose to US$33.1 billion in 2017, making it the largest pet category at 39 percent of the market. The nearly 5 percent growth experienced by pet food in 2017 matches that of 2016.

The growth challenges of current purchasing trends

Continuing the trend of channel migration, pet product sales growth is mostly occurring outside of the core mass-market and pet specialty channels — namely online, where annual percentage sales gains have been in the mid double digits. Both the mass and the pet specialty channels are feeling the e-commerce heat, with big-box pet specialty especially hard hit, because mass may be poised to gain from the ongoing trickle down of the premiumization trend, driven in part by Blue Buffalo’s cross-over and acquisition by General Mills. Therefore, for the first time in years, mass channels may surpass pet specialty channels in pet food sales growth rates.

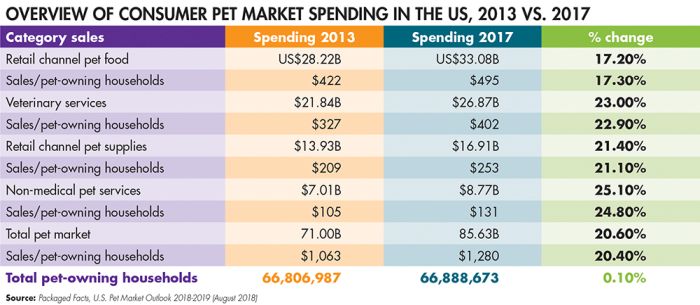

This turning of the tables points to a broader growth challenge for pet food manufacturers and retailers, notwithstanding pet food’s robust sales performance (which would be the envy of most major human food and beverage categories). The percentage of U.S. households who own pets has held relatively steady, hovering between 53 percent and 55 percent over the last decade, and growth in the overall number of pet-owning households between 2013 and 2017 was almost negligible (0.1 percent; see Table 1).

TABLE 1: Growth in the number of overall pet-owning households has stagnated, shifting pet sales growth into channels frequented by those who are willing and able to spend more money on their furry companions.

Pet ownership and market influence

Moreover, the most recent data may signal a rebound in ownership rates for cats and some “other” main types of pets, against a flattening out, or even slippage from recent peaks, in pet ownership rates for dogs. A tandem trend: those living in residences other than owned homes — the most practical housing type for keeping pet dogs — are on the rise in share of U.S. households overall and in share of pet-owning households.

The urbanization and dense residential trends that have helped make cats more commonplace than dogs as pets may therefore be nipping at the heels of the U.S. pet market — and thus of pet market sales volume and profits, because average consumer spending on dogs (as the most humanizable pets) is higher than average spending on cats or any other main types of pets. (The pet shark trend reported in July by the Wall Street Journal would be an exception.)

Factoring in pet ownership along with U.S. population growth trends, the customer base of dog-owning households edged up by 1.7 million households between 2013 and 2018, compared with a 5.5 million jump in the previous five-year period between 2008 and 2013. In addition, multiple-pet ownership rates have sagged somewhat, both in absolute numbers and in percent of pet-owning households. The percent of pet owners with dogs and any other type of pet, for example, has fallen from 17 percent in 2008 to 15 percent in 2018.

The dependence of pet food sales on dollar growth

Future pet food sales growth therefore remains heavily reliant on higher-income households, which are better able to afford the premium and superpremium products driving dollar but not volume growth. Packaged Facts predicts that veterinarians and pet food nutritionists (above and beyond effective marketing) will take a more leading role in driving dollar sales growth in coming years, especially through one-on-one professionalized and customized pet food formulation recommendations for individual dog and cat owners.

Source: Pet Food Industry, October 2018