CREDIT: BRIAN STAUFFER FOR VARIETY

By BRIAN STEINBERG

Source: variety.com, August 2019

At a time when TV viewers have more power than ever to skip past commercials, Madison Avenue is acting like it’s the heyday of the Pillsbury Doughboy, Toucan Sam and Mr. Whipple.

TV ads, those 30-second sales pitches that prognosticators like to say are on the way out and about which consumers complain incessantly, are suddenly popular again – at least among the people who buy them. How else to explain why big advertisers, with a dizzying array of new ways to reach customers with social media and digital video before them, keep raising the amount of money they intend to spend on primetime TV?

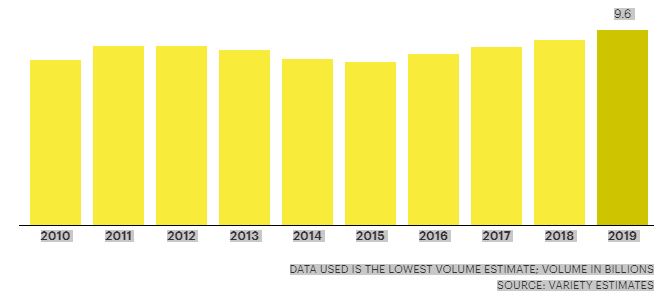

To be sure, TV ratings continue to erode. But the nation’s five English-language broadcast networks prevailed against disruptive trends brought on by new streaming-video technology and managed to snare a gain of between 5.5% and 7.4% in the volume of advance advertising commitments they secured for their next cycle of primetime programming, according to Variety estimates, part of the annual haggling of TV’s “upfront” ad-sales marketplace. The networks secured between $9.6 billion and $10.8 billion for primetime, according to Variety estimates, compared with $9.1 billion and $10.06 billion in last year’s haggle. It is the fourth consecutive year that the networks have seen increasing volume for their primetime schedules.

The numbers are little more than fuzzy math and rarely have any correlation to the ad money big media owners like CBS, Walt Disney, NBCUniversal, Fox Corporation and WarnerMedia collect by the end of the year. But they do lend ballast to the notion that, despite a frenzy of calls predicting Big TV’s rapid demise, advertisers do not share that view.

“This year’s advertising upfront was one of the strongest we have seen in many years,” said Lachlan Murdoch, executive chairman and CEO of Fox Corporation, during a call with investors on Wednesday.

UPFRONT VOLUME

IN PRIMETIME, AMONG FIVE ENGLISH-SPEAKING BROADCAST NETWORKS

| YEAR | VOLUME |

|---|---|

| 2010 | $8.1B to $8.7B |

| 2011 | $8.8B to $9.3B |

| 2012 | $8.8B to $9.3B |

| 2013 | $8.6B to $9.2B |

| 2014 | $8.17B to $8.94B |

| 2015 | $8.02B to $8.69B |

| 2016 | $8.41B to $9.25B |

| 2017 | $8.78B to $9.62B |

| 2018 | $9.1B to $10.06B |

| 2019 | $9.6B to $10.8B |

Why are advertisers relying even more on top-priced TV than they have in the past? Part of it appears to be disillusionment with aspects of digital media. Procter & Gamble, Unilever and AT&T have over the space of the past year put a spotlight on unsavory aspects of some of the new ways marketers reach their target base. They are concerned about having their commercials show up alongside offensive video content that some of the social-media giants appear to have problems vetting. And they are less than satisfied with measurement of how commercials are reaching and being recalled by digital users.

“I think there is a move back” to TV from digital, said David Zaslav, CEO of Discovery Inc. Wednesday, speaking with investors. “There is a feeling of safety. What are you next to? What are you buying? Who is the talent that you’re buying? What’s the environment that you are buying? You can do that on television and in digital, there is a fear of that.”

Even advertisers who have thrived in the digital realm are moving more directly into TV. One of the big factors buoying the 2019 upfront was a rush by upstart companies that have primarily used digital to reach consumers in more direct fashion into a medium that is known to reach bigger, broader audiences. Online retailers like Wayfair and Warby Parker, digital-service companies like Peloton and a growing phalanx of streaming-video companies like Amazon and Netflix are increasingly using TV ads to spark the biggest conversation they can have with the widest audience possible. Little wonder that the last few Super Bowls have been inundated with commercials from streaming-video giants eager to get consumers to subscribe for a chance to view “Hanna,” “The Irishman” or “Game of Thrones.”