By Stephanie Crets

Source: www.digitalcommerce360.com, March 2020

In the short-term, retailers that sell supplies like toilet paper, face masks and water bottles are having significant sales gains due to the coronavirus. Long-term, however, retailers are concerned the coronavirus will negatively impact their 2020 revenue.

The virus causing the coronavirus disease 2019—called COVID-19—continues to spread across the globe, and online retailers are wondering, “How will the coronavirus affect my online business?” Events, like Shoptalk, Adobe Summit & Magento Imagine and South by Southwest, are postponed or canceled. Many retailers are having online sales spikes in flu-related products, such as cleaning supplies and health products. However, the long-term impact for the coronavirus is not yet known, and many retailers are lowering their sales forecasts for the year. Retailers that manufacture or supply their goods from China are unsure of how this will impact their supply chain, or how this will impact demand for their products.

47% of retailers expect some downside in revenue due to the coronavirus, according to a survey conducted in March 2020 of 304 retailers by Digital Commerce 360. 33% of retailers say it’s too early to tell. However, a majority of retailers, 58%, say the virus will impact consumer confidence, and 22% say there will be a significant impact. Consumer confidence is often used as a measure of how consumers feel about the economy.

The coronavirus increases sales for health products

Online sales have increased 52% compared with the same time frame a year ago, and the number of online shoppers has increased 8.8% since the coronavirus began, according to SaaS platform provider Quantum Metric. The firm analyzed 5.5 billion anonymous and aggregated online and mobile visits to retailer websites from U.S. consumers. Jan. 1 and Feb. 29.

Site search provider Bloomreach found similar increases for its 250-plus retailer clients, such as grocery chain Albertsons Cos. Online sales increased the week of Feb. 22-29 compared with the prior week for health related items. The coronavirus has increased sales for the following:

- Masks sales increased 590% from the week prior

- Hand sanitizer sales increased 420% from the week prior

- Clorox/Lysol wipes sales increased 184% from the week prior

- Disinfectants sales increased 178% from the week prior

- Gloves sales increased 151% from the week prior

- Bottled/packaged water sales increased 78% from the week prior

- Vitamins sales increased 78% from the week prior

- Tissues sales increased 43% from the week prior

- Hand soap sales increased 33% from the week prior

- Toilet paper and paper towels sales increased 26% from the week prior

Mask retailer Debrief Me can testify to the influx in sales since the coronavirus news spread. The retailer sells masks in different colors and styles that consumers wear for anti-pollution measures and to prevent the spread of viruses and germs. The retailer says its masks are engineered to block 99% of all contaminants found in the air.

Debrief Me sells its masks on DebriefMe.com and via Amazon.com with 89 SKUs. It fulfills its products—which come from its Chinese manufacturer—from a warehouse in Georgia. Otherwise, Amazon Fulfillment By Amazon takes care of its Amazon sales. The retailer declined to provide specifics of its website versus Amazon sales.

Debrief Me says its sales have grown 10 times since the coronavirus threat became public. The retailer also moved its products to its Georgia fulfillment center before the factories began to shut down in China. “We were able to get in front of it, and I contacted my factory so, I got my products out of China before the Chinese New Year and before the shutdown,” says Debrief Me’s founder and CEO Matt E Silver.

Since then, production has resumed at Debrief Me’s China factory. However, its factory is still having problems getting workers back to the factory to operate it at full capacity, Silver says. “We are getting product out, slowly by air, and it’s trickling in every day,” he says.

Next week, Debrief Me will begin to produce one of its masks in its Brooklyn, New York-based production facility, Silver says. “We will be able to make products in Brooklyn and soon in other parts of the country,” he says. “We are securing our own U.S. supply line for the country with explosive growth. And we’re diversifying our dependency on supply from any foreign countries.”

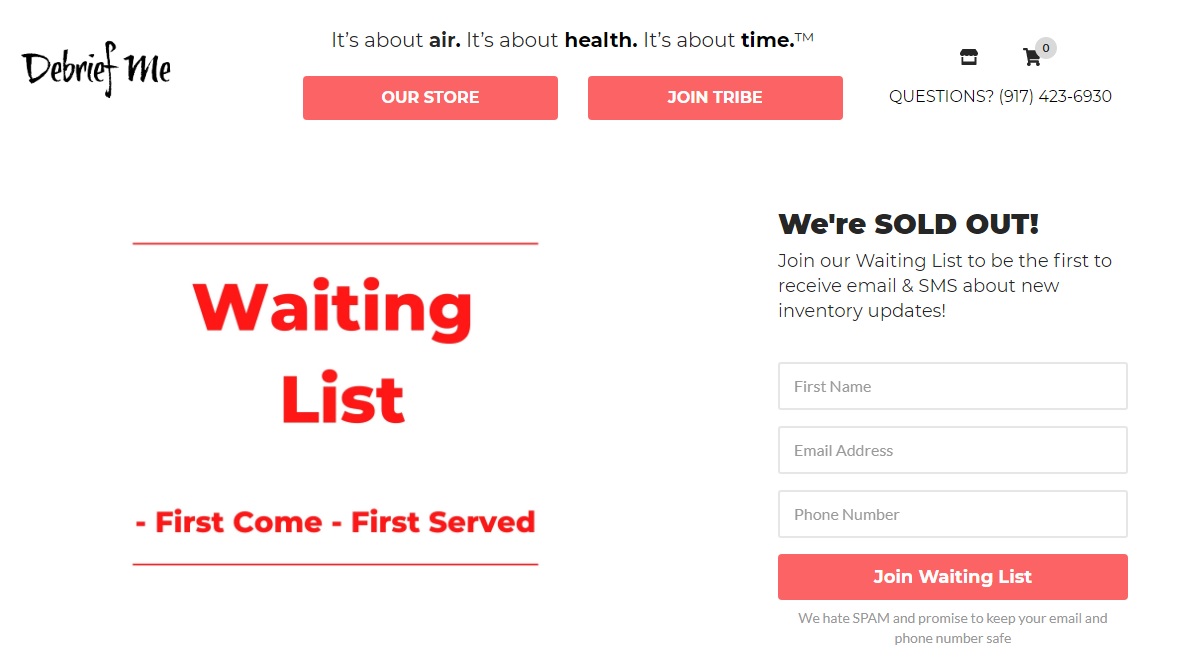

The retailer has fielded 200 to 300 customer service messages per day with its 11-person staff, sold a “huge amount” of masks in China and sold out of masks in Japan in one day, Silver says. As of publication, its masks are completely sold out, and it launched a first-come, first-serve waiting list on March 10 to be notified when items are back in stock. As of March 11, more than 800 people have signed up for the wait list.

Debrief Me also is looking to expand its mask line to 10 different products, and it plans to sell its masks in big-box retail stores, but Silver declined to specify which ones. “We are getting calls from retail stores and talking to most of the big-box stores,” Silver says. “We’re aggressively expanding worldwide.”

Expect delivery delays for online orders

Not all retailers, however, have had sales gains because of the wealth of problems associated with COVID-19, such as supply chain issues and potentially fewer shoppers in stores who do not want to risk exposure. For example, there is a large impact on imports at major U.S. retail container ports due to factory shutdowns and travel restrictions in China that affect production and fulfillment, according to the Global Port Tracker report released this week by the National Retail Federation and Hackett Associates.

“There are still a lot of unknowns to fully determine the impact of the coronavirus on the supply chain,” says Jonathan Gold, NRF vice president for supply chain and customs policy. “As factories in China continue to come back online, products are now flowing again. But there are still issues affecting cargo movement, including the availability of truck drivers to move cargo to Chinese ports. Retailers are working with both their suppliers and transportation providers to find paths forward to minimize disruption.”

44% of retailers expect product delays due to the coronavirus, and 40% expect inventory shortages, according to the Digital Commerce 360 survey.

Online retailers have a negative outlook for 2020

Plus, many retailers have changed their 2020 outlook from a positive outlook to a negative one, as they are expecting sales and revenue to fall. 36% of retailers surveyed this month say their ecommerce business will be down due to the coronavirus, while 26% say ecommerce will be as projected.

Online marketplace Etsy Inc., for example, said that only a small percentage of supply and demand is in China, so it hasn’t had much of an impact on Etsy sellers yet. Etsy is No. 18 in the just-released ranking of Digital Commerce 360 Online Marketplaces.

Urban Outfitters Inc., No. 45 in the 2019 Digital Commerce 360 Top 1000, is keeping a close eye on the coronavirus and how it will impact its supply chain and demand for its products. “The bottom line is COVID-19 creates supply chain uncertainty and could create demand uncertainty as well,” said CEO Dick Hayne.

Erik Nordstrom of Nordstrom Inc. (No. 18 ) also mentioned the coronavirus and its potential impact on Nordstrom’s supply chain on the retailer’s Q4 earnings call.

“We’re monitoring this flu situation closely, with the well-being of our customers and employees as the top priority,” he said. “We have a team focused on monitoring, planning for, and responding to any potential impacts the virus may cause to our business. Our private label business makes up around 10% of sales, with less than 30% sourced from China. We are communicating with our vendors and brand partners as it relates to merchandise deliveries. We’re looking at this on a case-by-case basis and planning accordingly.”

Target (No. 16) says demand for its cleaning products, medicine and pantry stock-up items is high, and it is limiting the number of key items per purchase, which will allow more guests to get what they need, CEO Brian Cornell said in a note to shoppers. It also has increased its staff to support its omnichannel services, such as buy online pick up in store and curbside pickup. And as a preventative measure, Cornell said Target will be cleaning surfaces like checklanes and touchscreens at least every 30 minutes in its stores.

“For the foreseeable future and next few months, foot traffic dropoff to stores is a big concern for brands. But the big question of how they can mitigate consumer fear remains,” says Tom Buiocchi, CEO of SaaS facilities management platform ServiceChannel. “One way is by ensuring consumers that they are taking health and safety seriously by taking the proactive steps of deep cleaning their stores or increased cleaning schedules. It’s not just an aesthetic issue anymore; it’s a step in rebuilding consumer trust.”