Article by Sara Lebow

Source: www.emarketer.com, July 2021

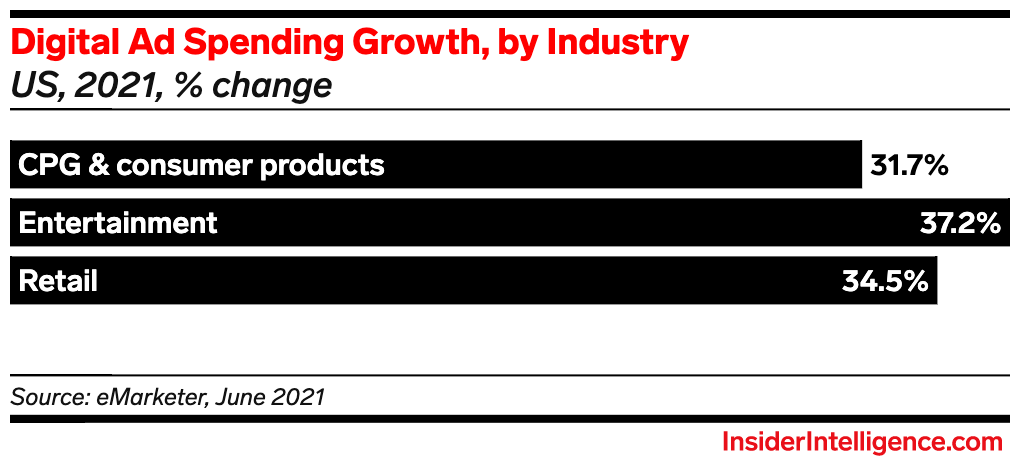

The forecast: Following mixed effects of the pandemic in 2020, the US retail, consumer packaged goods (CPG), and entertainment industries are rebounding in 2021. By the end of this calendar year, we expect that each of these industries will grow their digital ad spending by over 31%.