It’s all about convenience

The restaurant industry may be at the point of finally turning the corner after a long slump, but don’t look for traditional restaurant solutions to drive the turnaround.

Market research firm The NPD Group on Monday forecast 2018 total restaurant industry traffic will see “flat to sluggish growth,” continuing a yearslong industry trend. However, the forecast trajectory could tilt in a positive direction as more women enter the labor force, leaving them strapped for time and driving increased demand for convenience options.

One such option is delivery. Nearly half of dinners purchased from a restaurant are now eaten at home, up from 47% in 2012, said Bonnie Riggs, NPD’s restaurant industry analyst. For an “industry that’s not growing,” the few percentage points’ increase is significant, she noted.

“It’s a convenience-driven market,” Riggs added. “Anybody who wants to grow their business is going to have to satisfy consumer needs for convenience. This is the new reality—couch potatoes like hunkering down at home. They work all day. They want to be at home, but they don’t want to cook.”

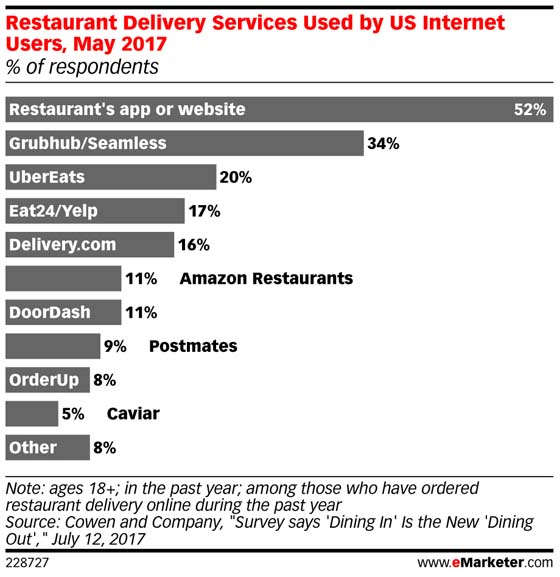

US restaurant delivery sales will rise an average of 12% per year to $76 billion in 2022, up 77% from 2017’s $43 billion, according to a Cowen and Company report published in July. Chains from fast-food giant McDonald’s to casual dining chain Buffalo Wild Wings have all called out delivery as a key growth strategy.

Part of the convenience trend can also be seen in what Riggs described as “the digital evolution of food service,” as orders via text messages and mobile apps continued to pick up along with the rise of third-party delivery service providers from Amazon Restaurants to UberEats.

Overall, digital orders have more than doubled between 2013 and this year, from 926 million to 2.3 billion. “If you are going to meet the convenience needs, you have to have a strong digital platform,” Riggs said.

Increased delivery options also translate into more choices for consumers beyond the traditional delivery options of pizza and Asian food. Orders outside of those areas have seen a double-digit increase even as delivery orders overall stood steady at 3% of the industry total.

In other key industry trends to watch for 2018, expect the return of value menus, evidenced by McDonald’s plan to introduce a new value menu early next year, Riggs said—adding that rivals will likely follow suit to ignite a new value war. Limited-time offers like Subway’s popular Reuben sandwich deal will be another weapon the industry will deploy to whet consumer appetite.

“[Limited-time offers] create a sense of urgency,” Riggs said. “Consumers like them because they create buzz and excitement. Restaurants are going to pull any [marketing trick] to drive traffic.”

by Andria Cheng