In a presentation at Luxury FirstLook 2017: Time for Luxury 2.0 on Jan. 18, the executive shared that across all generations, consumers mention descriptors such as “quality,” “name-brand” and “expensive,” but different age groups show varied attitudes toward luxury, with boomers’ “overpriced” more negative than millennials’ “rich.” As brands increasingly target millennials, who represent 50 percent of all luxury buyers, they need to alter their language accordingly.

“You need to look at what language you use,” he said. “From my work, many times I hear companies who are targeting millennials using boomer language, which I don’t think is really the way to go about targeting and speaking with this very important and who I call the future market for luxury.”

Multichannel marketing

Luxury shopping tends to be a two-step process involving research and the actual purchase. While 76 percent of luxury conversions occur in-store, 81 percent of luxury buyers name digital channels as their preferred means of research about a product.

Four out of the top 10 channels for ad recall among all luxury buyers were digital, but traditional media such as radio, newspapers, magazines and snail mail made the cut, with television coming in number one.

Image courtesy of Ralph Lauren

When trying to reach an affluent audience, the channels that marketers use to disseminate their message often reach a greater portion of mass consumers than the wealthy, according to a recent report by Shullman Research Center.

While the general population of adults is most apt to remember seeing placements on television, those with at least $1 million in assets most recollect ads served on Facebook. Aside from divides among millionaires and non-millionaires in media consumption and engagement, different generations of affluent consumers are more reachable on different advertising platforms (see story).

Consumption competition

Of the 67 million Americans who consumed luxury in the past 12 months, 60 percent are also Amazon customers. While Amazon is not a major player in the luxury space, it has been called a disruptor in retail, setting expectations for consumers.

According to Mr. Shullman, Amazon has successfully listened to consumers, working to remove any friction or obstacles to their shopping experience, including competitive prices and free, speedy shipping. About three-quarters of the 151 million U.S. consumers who have shopped at Amazon rate the marketplace as superior to other retailers, and about two-thirds shop with Amazon at least once a month.

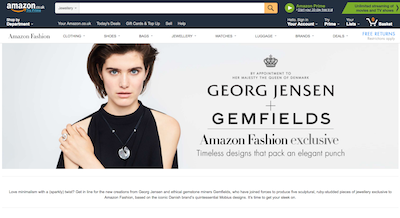

While some brands, such as Georg Jensen (see story), have launched partnerships with Amazon, luxury labels on the whole are hesitant of working with the retail giant. Amazon is finding ways around this, establishing its own in-house fashion and accessories label.

Amazon Fashion Europe was the exclusive retailer of a Georg Jensen x Gemfields collaboration

This past summer, Amazon also launched a mobile-optimized marketplace within its online Web site that focuses on all things automotive, hoping to become a full-service hub for vehicle purchases and information (see story).

In collaboration with BAV Consulting, Shullman Research looked at Amazon’s brand equity and growth potential. In both brand strength and stature, Amazon is constantly rising, placing it in the top .03 percent of the more than 50,000 brands BAV studies.

The retailer’s strength is the same whether looking at all consumers or those with household incomes of at least $100,000.

Among the affluent, 88 percent deem Amazon worth paying more for than other brands, placing it ahead of Dior, Jaguar and the Four Seasons. It also earns top marks for trendiness and intelligence, beating out Audi and Tesla, respectively.

“Amazon is something you’re going to have to deal with whether you like it or not,” Mr. Shullman said. “The question to me is not if, it’s a question of when.”

By SARAH JONES