Banks aren’t turning off their customers with their communications, though more personalized information would be welcome, according to a study from Segmint [pdf]. Asked which of 5 organizations deliver the most annoying communications, respondents overwhelmingly pointed to credit card companies (53%) first, with far fewer citing banks (16%).

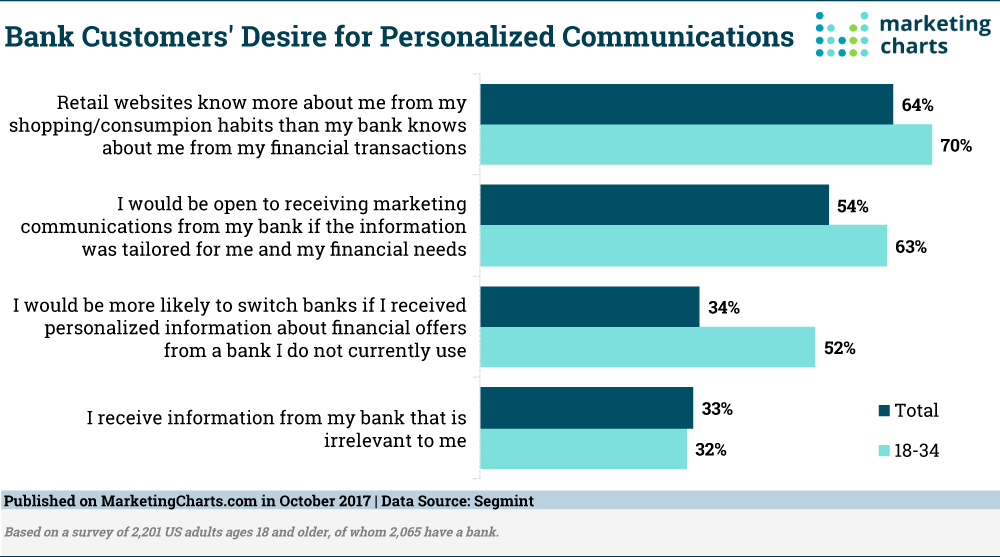

Even so, the results suggest that banks would appeal more to their customers were they to send more personalized information. In fact, almost two-thirds of the bank customers surveyed agreed that retail websites (such as Amazon, Zappos and Netflix) know more about them from their shopping and consumption habits than their banks know about them from their financial transactions.

Further, a majority (54%) would be open to receiving marketing communications from their bank if the information was tailored for them and their financial needs. Desire for tailored communications was higher among Millennials (63%); other research has likewise found that Millennials prioritize personalized communications more than other adults.

Overall, one-third of bank customers report receiving information from their bank that is irrelevant to them. A similar proportion would be more likely to switch banks if they received personalized information about financial offers from a bank they don’t currently use, suggesting that these communications can have an impact on customer loyalty.

Customers Want More Financial Advice

In an earlier data release [pdf] from the survey, Segmint’s survey revealed that 8 in 10 customers expect their bank to provide them with information to help them make better financial decisions.

However, just 28% said that their bank provides them with information that helps them reach their personal financial goals, and only 24% have a good understanding of all the diverse products and services their financial institution offers.

Those results indicated that younger customers want information – and in some cases are finding what they need. The 18-34-year-olds surveyed displayed an above-average expectation for information from banks (86%), but also were more likely than the overall sample to say their bank provides them with such information (33%) and that they have a good understanding of their bank’s products (32%).

A comprehensive and in-depth report from MarketingCharts – which is available for purchase here – had identified financial advice as a critical aspect of marketing financial services to Millennials. The study found that Millennials of various stripes ”“ including college students and affluents ”“ would benefit from financial advisors, which financial institutions can use as competitive differentiators. The opportunity for financial institutions to provide advice to Millennials is particularly acute considering that while few are happy with their financial activities, a majority don’t know who to turn to. However, trust is an issue, as only 1 in 3 feel that they are understood by their bank.

About the Data: The Segmint results are based on a survey of 2,201 US adults ages 18 and older, of whom 2,065 have a bank.