(image credit: iStock)

ROB STOTT, CORPORATE COMMUNICATIONS MANAGER, NATIONWIDE MARKETING GROUP

Source: www.twice.com, May 2021

Editor’s Note: This article originally appeared in Independent Thinking, Nationwide Marketing Group’s member newsletter and is reprinted with permission.

When historians and economists alike look back, April 2021 will likely be deemed the month that the pandemic turnaround really kicked into high gear. As of this writing, roughly 45 percent of the U.S. population (107 million people) has received at least one dose of the coronavirus vaccine, which is great news. And as more Americans get protected against COVID, they’re also showing a willingness to return to in-person shopping.

Two recent studies looked at mall traffic and traffic in apparel stores, and both showed incredibly promising signs. Both were conducted by retail traffic data firm Placer.ai. The first looked at foot traffic in 50 of the top-tier malls across the U.S. According to that firm’s data, mall traffic was up an astronomical 86% year-over-year. That data is certainly helped by the fact that Malls were effectively shut down during the first months of the pandemic. But Placer went back further to compare 2021’s numbers to 2019. There, they still found traffic to be up nearly 24% this year compared to 2019.

In Placer’s second study, they looked more closely at weekly visits to apparel stores. As of April 5, visits were down 3.4% compared to the same week in 2019. That’s a vast improvement from earlier this year when weekly store visits were hovering around -20%.

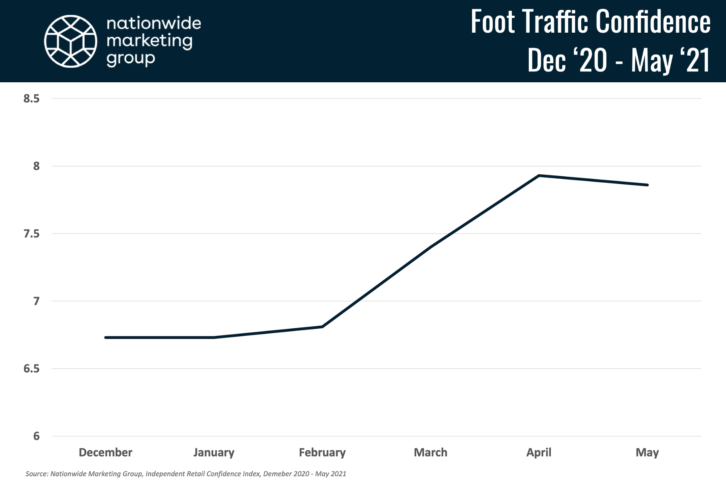

A bit closer to home, Nationwide’s data from the ongoing Independent Retail Confidence Index tracks along a similar trend line. When asked how confident they are in their ability to drive foot traffic into their stores, Nationwide members approached an 80% confidence level in April and May, up from closer to 65% between December and February.

What must be top-of-mind for retailers, though, as they welcome shoppers back into their stores is that preferences for how they want to shop have changed since the last time they ventured out into a physical store. A survey conducted by PYMNTS found that, even after they get their vaccine and feel comfortable returning to in-store shopping, 75% of consumers still want a digital-first experience.

Diving deeper into that number, PYMNTS survey found that 41% of consumers are shopping more via mobile than they were before the pandemic. At retail, specifically, 78 percent of respondents stated they will maintain all or some of their online shifts. And not only are they going to maintain those digital shifts, a large portion of consumers (57 percent) said they will base their future shopping decisions on the digital payment offerings a retailer provides.

With that in mind, retailers can (and must) find was to cater to that digital-first experience throughout their in-store experience. Some options might include:

- Digital price tags. Digital tags offer a number of benefits for retailers, including higher margins than stores employing paper tags and time saved stripping and replacing paper tags — just to name a few. But digital tags also bring the online experience in store by offering greater detail about a product, including review ratings, in-stock availability and more.

- QR codes. Consumers simply shop with their phones in their hands nowadays, there’s no denying that. So, capitalize on it. Placing QR codes on product throughout the store that link to your website so they can get more details about the model they’re looking at. Or maybe they lead to a form to fill out (letting you capture their info) in exchange for a special promotion.

- Digitize checkout. Remember that your customers have been spending the better part of the past year buying product online. A few taps and they’re able to complete the checkout process online. Bring that kind of checkout experience into your store with tap-to-pay options, or text-to-apply credit card applications.

As we’ve learned over the past year — and as the surveys above show — the way consumers expect to shop in stores has drastically changed. And that change is not expected to be temporary. Investments in upgraded in-store experiences and technology are only going to benefit the retailers who make them.

See also: NMG, Pricer Announce Digital Price Tag Preferred Partner Program